You can choose the languages of this post.

Thoughts After Joining the Ranks of Upper Mass in My 30s

What Is Upper Mass?

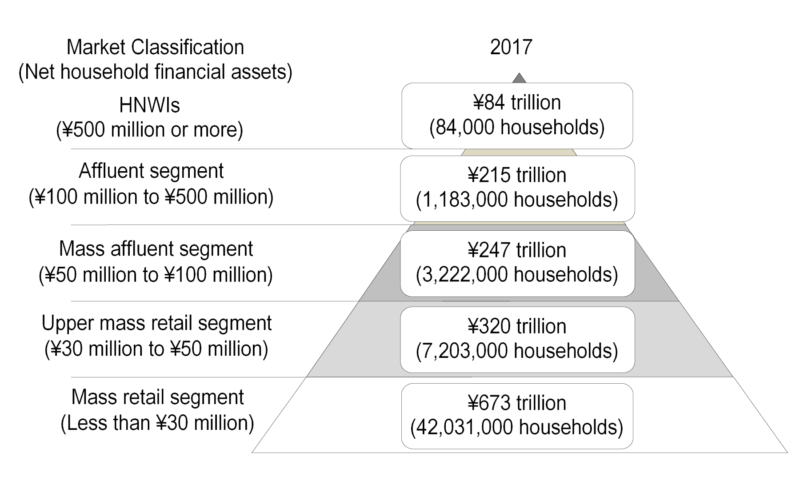

Nomura Research Institute, Ltd. (NRI) has estimated the number of households and household asset size in Japan as classified by the amount of net financial assets owned from various statistics.

Upper mass is one of the segments for the asset levels as classified by net financial assets.

Based on the amount of net financial assets owned by the household such as savings, investment, and bonds, etc. (total value of financial assets minus debts), there are 5 segments below:

| Segments | Financial Asset Range |

|---|---|

| High Net Worth Individuals | ¥500 million or more |

| Affluent | ¥100 million to ¥500 million |

| Mass Affluent | ¥50 million to ¥100 million |

| Upper Mass | ¥30 million to ¥50 million |

| Mass | less than ¥30 million |

The net financial assets exclude real estate like houses.

Number of Households and Household Asset Levels as Classified by Net Financial Assets

The result of the estimation in 2017 is below.

The proportions of each asset level are the followings:

High Net Worth Individuals: 0.16%;

Affluent: 2.20%;

Mass Affluent: 6.00%;

Upper Mass: 13.41%;

Mass: 78.24%.

4 out of 5 Japanese people are classified in the mass segment and 1 out of 8 is classified in the upper mass segment.

In addition, only a few people can be classified in the mass affluent segment because there is only 1 out of 17.

By the way, 1 out of 45 for Affluent and 1 out of 625 for High Net Worth Individuals are classified respectively.

Reasons to Reach Upper Mass; Simplicity & Frugality and Life in Egypt

There were 2 reasons to reach upper mass even though I’m the one who has worked at a Japanese company without a university graduate.

1. Simplicity and frugality;

2. Life in Egypt.

These were essential factors for me to achieve it.

Living of Simplicity and Frugality

-

Living with my parents until marriage;

-

Putting my money to property savings and Employee Stock Ownership Plan;

-

Uncostly hobby (walk and eat).

I have not spent much money for living such as an apartment or hobbies.

And I put my surplus money into property savings and the Employee Stock Ownership Plan of my company.

On the other hand, I have spent some money and made mistakes as people might do as follows:

My Experience of Expenses and Failure

- Loss in the Employee Stock Ownership Plan (minus ¥1.5 million).

- More than 10 years car ownership;

- Once a year overseas trip.

Out of all these experiences, life in Egypt was a big difference between most people and me.

Since the cost of living in Egypt is cheaper than the one in Japan, my expenses also decreased. Besides, my income increased and more money could be moved for savings.

Although I was in Egypt for only 3 years, I was able to boost my savings.

Even if you make much money, it’s not that the net financial assets are big. So, simplicity and frugality are also necessary for making many assets.

My Thoughts after Reaching Upper Mass

Even though most people classified in upper mass include risk assets such as stocks in their portfolio, mine contains almost all savings only.

I was able to achieve a wonderful result only by making small efforts.

So, the money worths more than the actual price for me.

I was able to prove the only way to go far beyond what I expected is to keep taking small steps forward.

This would work not only to make assets but also for your skill, side hustles, health, and relationship.

I will make a continuous effort for other fields by making use of my experience.

Obviously, I’m going to move the next segment of my assets by taking advantage of risk assets.

Thank you very much for reading.

Have a lovely evening!!